First Time Home Buyer Checklist: Your Essential Guide

Stepping into Homeownership: Your Essential Guide

Buying your first home in NZ is a huge step! This first time homeowner checklist simplifies the process, outlining eight essential tasks to tackle before and after you get the keys. From establishing a realistic budget and securing proper home insurance to understanding your home's systems and planning for property tax, this guide provides the knowledge you need for a smooth transition. Follow these steps to confidently navigate homeownership and set yourself up for long-term success.

1. Establish a Realistic Budget

For first-time homeowners in NZ, establishing a realistic budget is the most crucial step in the entire home-buying process. It's the foundation upon which your homeownership dreams are built. This means understanding all the costs associated with owning a home – not just the mortgage repayments. A comprehensive budget will encompass everything from property rates and insurance to utilities, maintenance, and those inevitable unexpected repairs. By accurately forecasting these expenses, you can avoid financial strain and ensure you can comfortably afford your new home. This deserves its place at the top of any first-time homeowner checklist because it sets the stage for a positive and financially secure homeownership experience.

A realistic budget involves a detailed breakdown of your anticipated monthly housing expenses. This includes:

-

Mortgage Repayments: Factor in current interest rates and consider potential fluctuations.

-

Property Rates: These vary by council and property value, so research the rates for your target area.

-

Home Insurance: Protect your investment with adequate building and contents insurance.

-

Utilities: Estimate costs for electricity, gas, water, and internet.

-

Maintenance & Repairs: Set aside a portion of your budget for regular maintenance (e.g., gardening, cleaning gutters) and potential repairs (e.g., plumbing issues, appliance replacements). A good rule of thumb is to allocate 1-3% of your home's value annually for these costs.

-

Body Corporate Fees (if applicable): If you're buying an apartment or unit, factor in these fees which cover building maintenance and shared amenities.

Beyond monthly expenses, your budget should also incorporate long-term savings planning for major home upgrades or renovations down the line. Calculating your debt-to-income ratio is also vital. This helps lenders assess your borrowing capacity and ensures you're not overextending yourself financially. The commonly used 28/36 rule suggests that housing costs shouldn't exceed 28% of your gross monthly income, and total debt payments (including your mortgage) shouldn't exceed 36%.

Examples of Successful Implementation:

-

Using the 28/36 rule to determine an affordable mortgage amount.

-

Setting aside $2,000 annually for maintenance and repairs on a $600,000 home.

-

Building a 6-month emergency fund specifically for unexpected home repairs.

Actionable Tips for First-Time Homeowners in NZ:

-

Use budgeting apps: Mint, YNAB (You Need a Budget), or Personal Capital can help you track expenses and stay on top of your budget.

-

Be thorough: Include all costs in your budget, not just the mortgage payment. Consider smaller expenses like lawn mowing or window cleaning.

-

Emergency fund: Aim for a 3-6 month emergency fund specifically dedicated to home repairs. This will provide a safety net for unexpected expenses.

-

Get pre-approved: Getting pre-approved for a mortgage will give you a clear understanding of your borrowing power and your true price range in the NZ housing market.

-

Seek professional advice: Consider consulting a financial advisor for personalised guidance.

Pros of Establishing a Realistic Budget:

-

Prevents overextending financially and reduces the risk of mortgage stress.

-

Creates financial security and peace of mind.

-

Helps prioritise necessary vs. discretionary spending.

-

Establishes good financial habits from the beginning of your homeownership journey.

Cons:

-

May limit the size or location of homes available to you.

-

Requires regular reassessment and adjustments as your circumstances change (e.g., salary increase, interest rate hikes).

-

Can be time-consuming to track all expenses initially, but it becomes easier with practice and the right tools.

Popularised by financial gurus like Dave Ramsey and Suze Orman, as well as organisations like the Consumer Financial Protection Bureau (CFPB), budgeting is a cornerstone of responsible financial management. By prioritising a realistic budget from the outset, you'll be well-equipped to navigate the exciting yet challenging journey of first-time homeownership in New Zealand.

2. Secure Proper Home Insurance

Protecting your new home is a crucial step in the first-time homeowner checklist. Securing adequate home insurance is not just a good idea—it's essential for safeguarding your investment and providing financial security. Home insurance offers comprehensive protection covering your home's structure, your belongings, liability for accidents on your property, and even additional living expenses if your home becomes temporarily uninhabitable. Understanding policy options and coverage limits is paramount for ensuring you're adequately protected against unforeseen events.

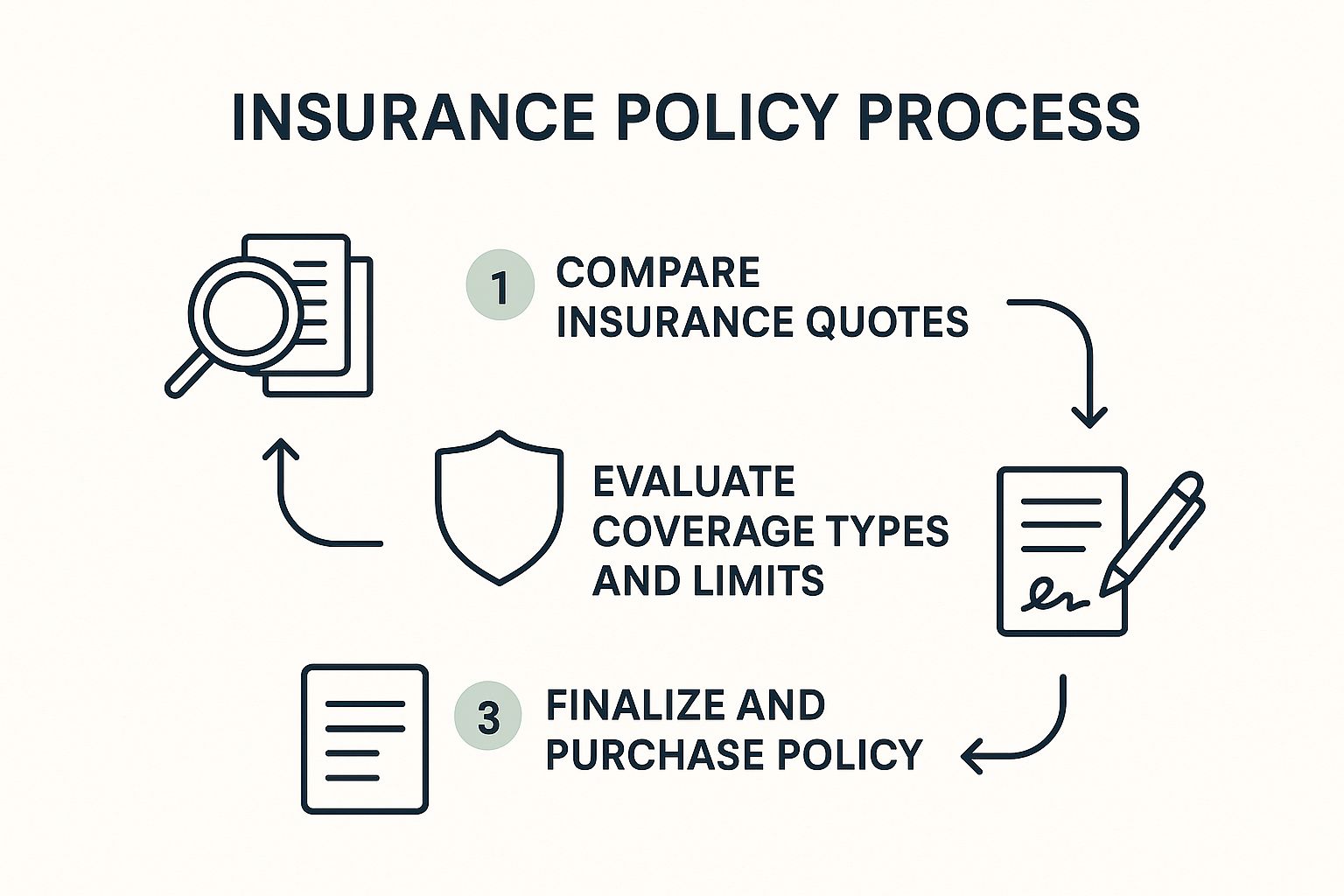

The infographic illustrates the process of securing the right home insurance, starting with assessing your needs, getting quotes, comparing policies, and finally purchasing the policy and reviewing it annually. This sequential approach ensures homeowners are proactive and informed throughout the process. As you can see, the infographic emphasises the ongoing nature of insurance management, highlighting the importance of annual reviews to adjust coverage as needed.

Several types of coverage are available, including dwelling coverage for the physical structure of your home, personal property protection for your belongings, liability coverage in case someone is injured on your property, and additional living expenses coverage if your home becomes uninhabitable due to a covered event. You can also add specialised riders for high-value items like jewelry or art, or for specific perils like earthquakes, which are often excluded from standard policies. In NZ, where earthquakes are a significant risk, considering this added protection is especially important.

Pros of Home Insurance:

-

Financial Protection: Shields you from financial ruin in case of fire, theft, natural disasters, or other covered events.

-

Mortgage Requirement: Most mortgage lenders in NZ require home insurance as a condition of the loan.

-

Liability Coverage: Protects you if someone is injured on your property and files a lawsuit.

-

Temporary Housing: Covers the cost of temporary accommodation if your home becomes uninhabitable.

Cons of Home Insurance:

-

Exclusions: Standard policies may exclude certain disasters like floods and earthquakes, requiring separate policies. Check with providers like the National Flood Insurance Program (NFIP) equivalent in NZ, as well as private insurers, for flood and earthquake coverage options.

-

Cost: Premiums can be expensive, especially in high-risk areas.

-

Deductibles: You'll need to pay a deductible when filing a claim, which can be a significant expense.

-

Coverage Limits: Ensure your coverage limits are sufficient to cover the full replacement value of your home and belongings, considering the current market in NZ.

Examples of Home Insurance Policies:

HO-3 policies, common in other regions, offer broad coverage. While the exact terminology might differ in NZ, the principle remains the same - find a policy that covers a wide range of perils while being aware of specific exclusions.

Tips for First-Time Homeowners in NZ:

-

Shop Around: Compare quotes from multiple insurers to find the best coverage and price.

-

Bundle for Discounts: Consider bundling home and auto insurance for potential discounts.

-

Document Belongings: Take photos and keep receipts of your belongings to simplify the claims process.

-

Annual Review: Review your policy annually to ensure coverage keeps pace with home improvements, inflation, and changes in your needs.

-

Security Systems: Installing security systems and smoke detectors may qualify you for premium discounts.

Popular insurance providers like State Farm, Allstate, Liberty Mutual, USAA, and Progressive operate primarily in the US. Research reputable insurers in NZ, compare their offerings, and choose the one that best suits your needs and budget. This is a vital part of your first-time homeowner checklist in New Zealand.

3. Create a Home Maintenance Schedule

As a first-time homeowner in NZ, tackling a home maintenance schedule might seem daunting, but it's a crucial step in protecting your investment and ensuring your home remains a comfortable and safe haven for years to come. A comprehensive home maintenance schedule is your key to preventing minor issues from snowballing into costly repairs and preserving your home's value. This system organises tasks by frequency—monthly, seasonally, and annually—ensuring that critical maintenance isn't overlooked amidst the excitement of settling into your new home. This item deserves a place on every first-time homeowner checklist because it empowers you to proactively manage your home, saving you money and stress in the long run.

This approach involves categorising tasks by season and setting up a calendar-based tracking system, either digitally or physically, to document completed work. Think of it as preventative medicine for your house. By implementing preventive maintenance protocols, you address potential issues before they become major headaches. For example, regular gutter cleaning prevents water damage, while annual servicing of your heat pump ensures efficient heating during those chilly Kiwi winters.

Features of a successful home maintenance schedule include:

-

Calendar-based tracking: This allows you to schedule and receive reminders for upcoming tasks.

-

Seasonal task categorisation: Grouping tasks by season ensures timely completion of essential maintenance relevant to NZ's specific climate.

-

Documentation: Keeping records of completed work, whether digital or physical, helps track maintenance history and warranty information.

-

Preventive maintenance protocols: This proactive approach addresses potential problems before they escalate.

Pros:

-

Prevents costly emergency repairs

-

Extends the lifespan of home systems and appliances

-

Maintains or increases property value

-

Improves energy efficiency and reduces utility costs

-

Creates peace of mind through proactive management

Cons:

-

Requires consistent time commitment

-

May involve learning new skills or hiring professionals

-

Initial setup can be overwhelming

Examples of Seasonal Tasks:

-

Spring: Clean gutters, inspect roof, service AC system, check for termites

-

Fall: Clean chimney (if applicable), check heating system, winterise outdoor plumbing

-

Monthly: Test smoke/CO detectors, check HVAC filters, inspect plumbing for leaks

Actionable Tips for First-Time Homeowners:

-

Use digital tools like HomeZada, Centriq, or simple calendar apps to track maintenance.

-

Create a dedicated maintenance fund for expected repairs (1-3% of home value annually). This will help you avoid financial strain when repairs are needed.

-

Take photos of utility shutoffs and keep them accessible.

-

Maintain a list of trusted service providers for each home system (plumber, electrician, etc.).

-

Keep all appliance manuals in one accessible location or digital folder. Learn more about Create a Home Maintenance Schedule for organisational tips.

While setting up a home maintenance schedule requires an initial time investment, the long-term benefits far outweigh the effort. Implementing a system now will save you significant money and stress in the future, allowing you to enjoy your new home to the fullest. This proactive approach is particularly beneficial for first-time homeowners in NZ, who are navigating the responsibilities of homeownership for the first time.

4. Assemble Essential Tools and Emergency Supplies

As a first-time homeowner in NZ, assembling essential tools and emergency supplies is a crucial step in your checklist. This preparation not only saves you money on unnecessary service calls for simple fixes but also ensures you're ready to handle unexpected situations like power outages, earthquakes, or severe weather events. Having the right tools on hand empowers you to address common household issues immediately, fostering self-sufficiency and confidence in your new role as a homeowner.

A well-stocked toolbox should include a basic tool kit for common repairs such as a hammer, screwdriver set (Phillips and flathead), pliers, wrench set, tape measure, and a level. Safety equipment like safety glasses and gloves are also essential. For emergency preparedness, gather supplies like flashlights, batteries, a first aid kit (consider supplementing with the items available at Learn more about Assemble Essential Tools and Emergency Supplies), bottled water, and non-perishable food. As you become more comfortable with home maintenance, consider adding specialised tools like a pipe wrench, circuit tester, stud finder, and a power drill. A ladder and extension tools are invaluable for reaching those tricky spots around your new home.

Examples of Successful Implementation:

-

Basic Toolbox: Equipping yourself with a starter tool kit from brands like Stanley, DeWalt, or Craftsman, readily available at retailers like Home Depot and Lowe's, covers many basic repair needs.

-

Emergency Kit: Following FEMA emergency preparedness guidelines and assembling a kit similar to those offered by the Red Cross ensures you're prepared for common emergencies.

Actionable Tips for First Time Homeowners in NZ:

-

Start Small, Grow Big: Begin with a basic tool kit and gradually add specialised tools as needed. Prioritise quality for frequently used tools like screwdrivers and drills.

-

DIY Learning: Leverage online resources like YouTube tutorials or consider attending community classes to learn basic home repair skills.

-

Accessible Emergency Supplies: Store emergency supplies in clearly labeled, easily accessible locations.

-

Emergency Contacts: Keep a list of emergency contacts, including utility companies and local emergency services, readily visible.

-

Regular Checks: Check your smoke detector and carbon monoxide detector batteries twice a year (daylight savings is a great reminder!).

Pros and Cons:

Pros:

-

Cost Savings: Addressing minor repairs yourself saves money on potentially costly service calls.

-

Quick Solutions: Having the right tools allows for immediate solutions to common household problems.

-

Increased Self-Sufficiency: Developing basic home repair skills boosts your confidence and independence as a homeowner.

-

Emergency Preparedness: A well-stocked emergency kit ensures you're prepared for unexpected events.

Cons:

-

Initial Investment: Building a comprehensive tool collection and emergency kit requires an upfront investment.

-

Storage Space: Tools and emergency supplies require dedicated storage space.

-

Maintenance: Tools require occasional maintenance and eventual replacement.

This item deserves a prominent place on the first-time homeowner checklist because it addresses both the practical, day-to-day needs of maintaining a home and the crucial aspect of being prepared for emergencies. By assembling essential tools and emergency supplies, you not only protect your investment but also ensure the safety and well-being of yourself and your household. This proactive approach ultimately contributes to a smoother, more confident transition into homeownership.

5. Understand Your Home's Systems

As a first time homeowner in NZ, tackling a home maintenance checklist can feel overwhelming. Understanding your home's systems is crucial and deserves a prominent place on that checklist. This means familiarising yourself with the electrical, plumbing, HVAC (Heating, Ventilation, and Air Conditioning), security, and structural elements of your property. Why is this so important? Because this knowledge empowers you to maintain your home properly, communicate effectively with tradespeople, and respond appropriately to emergencies, ultimately saving you time, money, and stress.

This understanding encompasses several key features: documentation of system locations and specifications (think user manuals and warranty information), knowledge of shut-off valve locations for water and gas, a grasp of your circuit breaker panel layout, awareness of structural elements and load-bearing walls, and HVAC system operation and maintenance requirements. Imagine a burst pipe – knowing where the main water shut-off valve is located can prevent significant water damage. Or, picture a power outage – understanding your circuit breaker panel will help you restore power quickly.

Pros:

-

Enables quick response to emergencies: Knowing how to shut off water or gas in an emergency can prevent costly damage.

-

Reduces dependency on professional help for minor issues: Resetting a tripped breaker or changing an air filter becomes a simple task.

-

Helps identify potential problems before they become serious: Recognising unusual sounds or smells from your HVAC system can alert you to a potential issue before it requires a major (and expensive) repair.

-

Facilitates more informed discussions with contractors: Understanding your systems allows you to ask pertinent questions and ensures you're getting the right service.

-

Prevents accidental damage during DIY projects: Knowing where pipes and wires are located can prevent accidental damage when undertaking renovations.

Cons:

-

Learning curve can be steep for those without a technical background: Don't be discouraged! Start with the basics and gradually build your knowledge.

-

Systems vary significantly between homes: What applies to one house might not apply to another. Take the time to learn about your specific systems.

-

Documentation may be incomplete for older homes: If you're purchasing an older home, be prepared to do some detective work or hire a professional for a thorough assessment.

Examples of Successful Implementation:

-

Create a home manual with labeled photos of shut-off valves and the circuit breaker panel.

-

Obtain original blueprints or create simple floor plans noting structural elements and load-bearing walls. This is especially helpful for renovations.

-

Document model numbers and warranty information for major appliances and systems in your home manual.

Actionable Tips for First Time Homeowners:

-

Request a thorough walkthrough from the previous owner or your home inspector. This is invaluable for understanding the specifics of your new home.

-

Label circuit breakers clearly for quick reference in emergencies. A few minutes labeling can save you valuable time when you need it most.

-

Take photos of areas behind walls before finishing renovation projects. This provides a visual record of wiring and plumbing locations, preventing accidental damage in the future.

-

Create a digital or physical binder with all system manuals and service records. Keeping everything organised will make maintenance and repairs much easier.

-

Learn the sounds and smells that might indicate system problems. A little awareness can go a long way in preventing major issues.

-

Schedule professional inspections of major systems annually. Regular maintenance can identify potential problems and extend the lifespan of your systems.

When furnishing your new home, choosing the right appliances is also a crucial step. Learn more about Understand Your Home's Systems to make informed decisions when purchasing appliances in NZ. This resource is helpful for first time homeowners looking for tips on buying appliances, whether you're seeking quality products for your kitchen, laundry, or any other area of your home. From budget-friendly options to understanding energy efficiency ratings, it's a valuable resource for anyone navigating the appliance market.

6. Plan for Property Tax and Mortgage Management

Managing your mortgage and property taxes effectively is a crucial aspect of successful homeownership, especially for first-time homeowners in NZ. This element of your first-time homeowner checklist deserves attention because failing to stay organised can lead to costly penalties, damage your credit score, and even put your home at risk. Developing a robust system for managing these significant financial commitments is essential for long-term financial stability and peace of mind.

This involves understanding several key components:

-

Mortgage Payment Tracking: Implement a system to track your mortgage payments. This could involve setting up automatic payments through your bank, using a budgeting app, or maintaining a spreadsheet. Knowing exactly when payments are due and confirming their successful processing is fundamental.

-

Property Tax Assessment Monitoring: In NZ, councils assess property values, which directly impact your rates. Stay informed about your property's assessment and be aware of revaluation periods. Monitoring ensures you're paying the correct amount and allows you to identify potential discrepancies.

-

Escrow Account Management (if applicable): Some mortgage lenders utilise escrow accounts to collect property taxes and homeowners insurance alongside your monthly mortgage payment. Understanding how your escrow account functions, ensuring sufficient funds, and reviewing annual statements are crucial for avoiding unexpected expenses.

-

Homestead Exemption Applications (if applicable): Research potential property tax exemptions available in your area. While "homestead exemptions" in the US sense may not directly apply in NZ, there might be other rebates or relief programs for certain homeowner demographics.

-

Tax Appeal Process Understanding: If you believe your property tax assessment is inaccurate, understand the appeals process within your local council. Knowing your rights and how to challenge an assessment can potentially lead to significant savings.

Examples of Successful Implementation:

-

Setting up automatic mortgage payments to avoid missed deadlines.

-

Creating calendar reminders for property tax due dates, especially if not escrowed.

-

Successfully challenging a property valuation through the council's objection process, resulting in lower rates.

-

Utilising budgeting software to track both mortgage principal and interest payments, visualising progress towards paying off the loan.

Pros of Effective Property Tax and Mortgage Management:

-

Prevents costly late fees and penalties.

-

Maintains a good credit score.

-

May identify opportunities for tax savings or rebates.

-

Provides documentation for potential tax deductions related to homeownership.

-

Creates financial predictability and reduces stress associated with large financial obligations.

Cons and Challenges:

-

Property tax increases can be unpredictable, affecting your budget.

-

Escrow shortages may occur, requiring additional payments to cover the deficit.

-

Tax rules and exemptions vary by location and can change over time.

Actionable Tips for First-Time Homeowners:

-

Consider making more frequent mortgage payments (e.g., fortnightly instead of monthly) to reduce interest paid over the life of the loan and potentially shorten the loan term.

-

Mark tax deadline dates prominently on your calendar or set up digital reminders if you're not using an escrow account.

-

Review your property valuation annually for accuracy and challenge it if necessary.

-

Research all available rates rebates and relief programs in your area.

-

Keep detailed records of home improvements and renovations, as these may affect your property's value and subsequent rates.

-

Consider setting up a dedicated savings account for property taxes if your mortgage doesn't include an escrow account, ensuring you have the funds available when due.

-

Beyond regular property taxes and mortgage payments, it's also essential to understand how your community handles special assessments. For example, if a major repair arises, you'll want to be prepared for how those costs are shared. More information on this can be found in this guide about Hoa special assessment rules from Town and Country Property Management.

By diligently following these steps and incorporating them into your first-time homeowner checklist, you'll be well-equipped to handle the financial responsibilities of homeownership in NZ, avoiding potential pitfalls and ensuring a smoother, more secure financial future.

7. Set Up Utility Services and Establish Energy Efficiency

Setting up your utilities and prioritising energy efficiency are crucial steps in your first-time homeowner checklist. This isn't just about flipping a switch; it's about ensuring a smooth transition into your new home and setting the stage for long-term savings and comfort. Failing to address these tasks early on can lead to frustrating service interruptions during move-in and potentially higher utility bills down the line.

This process involves coordinating with various providers to establish or transfer services for electricity, water, gas, internet, and waste management. For a seamless move, contact utility companies at least two weeks before your move-in date. Requesting copies of previous utility bills can help you estimate future costs and set a realistic budget. In New Zealand, you'll want to familiarise yourself with the local providers in your area to ensure you secure the best deals and services tailored to Kiwi homes.

Beyond simply connecting services, establishing energy efficiency from the outset is key to reducing your environmental impact and saving money on your monthly bills. This can involve a range of initiatives, from simple DIY tasks to professional assessments.

Features and Benefits of Early Energy Efficiency Planning:

-

Utility Transfer/Setup Procedures: Streamlining the process of connecting essential services.

-

Energy Audit Capabilities: Identifying areas for improvement through professional assessments.

-

Smart Home Energy Management Options: Utilising technology like smart thermostats and power strips to optimise energy use.

-

Insulation and Weatherproofing Assessment: Evaluating the effectiveness of your home's insulation and identifying opportunities to reduce energy loss. Consider adding attic insulation, especially relevant in colder NZ climates.

-

Alternative Energy Evaluation: Exploring options like solar power for a more sustainable approach.

Pros:

-

Prevents service interruptions during move-in.

-

Reduces monthly utility costs.

-

Increases home comfort.

-

Lowers environmental impact.

-

May qualify for tax credits or rebates.

Cons:

-

Initial investment in energy efficiency can be costly.

-

Some utility companies require deposits for new service.

-

Setup may require time off work for installation appointments.

Examples of Successful Implementation:

-

Scheduling utilities to be turned on 1-2 days before moving in.

-

Installing a programmable thermostat to save 10-15% on heating/cooling costs. For NZ homes, consider a heat pump system for efficient heating and cooling. Learn more about Set Up Utility Services and Establish Energy Efficiency

-

Adding attic insulation to reduce energy loss, particularly important for retaining heat during NZ winters.

-

Switching to LED lighting throughout the home for instant energy savings.

Actionable Tips for First-Time Homeowners in NZ:

-

Contact utility companies at least two weeks before your move.

-

Request copies of previous utility bills to estimate costs.

-

Schedule a professional home energy audit to identify efficiency opportunities.

-

Install weatherstripping and door sweeps for immediate energy savings.

-

Consider smart home devices like programmable thermostats and smart power strips.

-

Check for utility company rebates on energy-efficient appliances and upgrades. Many NZ providers offer incentives for energy-saving initiatives.

-

Compare internet service providers for best pricing and service. Fibre broadband is increasingly common in NZ, offering faster speeds.

This item deserves a place on the first-time homeowner checklist because it directly impacts your comfort, budget, and environmental footprint from day one. By proactively managing your utility setup and implementing energy-efficient practices, you'll be well-prepared to enjoy your new home and potentially save significant money in the long run. Popularised by programs like Energy Star certification, smart thermostats from brands like Nest and ecobee, local utility company energy efficiency programs, and LEED home certification standards, prioritising energy efficiency is a smart move for any homeowner, particularly in NZ with its focus on sustainable living.

8. Develop a Home Security Strategy

Protecting your new home and loved ones is a top priority for any first-time homeowner. Developing a comprehensive home security strategy is a crucial step in your first-time homeowner checklist, ensuring peace of mind and safeguarding your investment. This involves more than just locking your doors; it's about creating a layered approach to security, from assessing vulnerabilities to establishing emergency protocols.

A robust home security strategy encompasses several key areas:

-

Home Vulnerability Assessment: Walk around your property and identify potential weak points. Are there easily accessible windows? Does the landscaping provide cover for intruders? Identifying these vulnerabilities is the first step in addressing them.

-

Physical Security Measures: These are the foundational elements of your security plan. Install high-quality deadbolt locks on all exterior doors and ensure the strike plates are securely fastened. Reinforce windows with locks and consider security film to deter breakage. Exterior lighting is another vital component. Motion-activated lights around the perimeter of your home can deter potential intruders.

-

Electronic Security Options: Modern technology offers a wide range of electronic security solutions. Alarm systems, security cameras (like a Ring doorbell camera, for example), and smart home integration capabilities allow for remote monitoring and instant notifications. You can even explore options like a comprehensive SimpliSafe security system with professional monitoring. Learn more about Develop a Home Security Strategy for some practical examples.

-

Emergency Response Planning: In the event of a break-in or other emergency, having a plan in place is crucial. Establish clear exit routes from your home and designate a safe meeting place for your family. Store valuable documents and items in a fireproof safe.

Examples of Successful Implementation:

-

Installing deadbolt locks on all exterior doors and reinforcing window locks.

-

Setting up motion-activated exterior lighting around the property.

-

Implementing a Ring doorbell camera with phone notifications for added visibility.

-

Creating a comprehensive SimpliSafe security system with professional monitoring.

-

Utilising smart home integration to control lighting and security features remotely.

Pros:

-

Increased personal safety and peace of mind.

-

Potential reduction in homeowners insurance premiums.

-

Deterrent to potential intruders.

-

Provides valuable documentation in case of break-ins.

-

Modern systems offer convenient remote monitoring.

Cons:

-

Professional monitoring services incur monthly fees.

-

False alarms can result in fines from your local council.

-

Initial equipment costs can be substantial.

-

Some systems may require professional installation.

Actionable Tips for First-Time Homeowners in NZ:

-

Start with the basics: Invest in quality deadbolts, strong strike plates, and robust window locks. These are affordable and effective first steps.

-

Create the illusion of occupancy: Use timer switches or smart bulbs to make your home appear occupied even when you're away.

-

Landscaping for security: Consider incorporating thorny plants under windows and maintaining clear sightlines around your property.

-

Visible deterrents: Install visible security cameras or signs to discourage potential intruders.

-

Neighbourly watch: Establish a relationship with your neighbours for mutual property watching and support.

-

Emergency plan: Create a comprehensive emergency plan, including escape routes and a designated meeting point.

This item deserves a place on the first-time homeowner checklist because security is paramount. From basic measures like strong locks to advanced systems like professionally monitored alarms, a well-developed security strategy provides peace of mind, protects your investment, and safeguards your family. Companies like Ring, SimpliSafe, ADT, Vivint, and Google Nest offer a range of security products and services popular with homeowners in NZ. Remember that even small steps can make a big difference in enhancing your home security. Don’t forget to consider Crime Prevention Through Environmental Design (CPTED) principles when planning your security measures.

First-Time Homeowner Checklist Comparison

|

Checklist Item |

Implementation Complexity 🔄 |

Resource Requirements ⚡ |

Expected Outcomes 📊 |

Ideal Use Cases 💡 |

Key Advantages ⭐ |

|---|---|---|---|---|---|

|

Establish a Realistic Budget |

Moderate – requires regular tracking and updates |

Low – mostly time and financial planning tools |

Financial security, prevents overspending |

New homeowners planning affordability |

Prevents financial strain, good habits |

|

Secure Proper Home Insurance |

Moderate – involves research and policy selection |

Moderate – premium costs and documentation |

Protection from financial loss due to damage |

All homeowners needing risk coverage |

Financial protection, lender requirement |

|

Create a Home Maintenance Schedule |

Moderate – needs consistent time commitment |

Low to Moderate – scheduling tools, possible professional help |

Reduced emergency repairs, preserved home value |

Homeowners aiming for proactive upkeep |

Extends lifespan of home systems |

|

Assemble Essential Tools and Emergency Supplies |

Low to Moderate – initial setup investment |

Moderate – cost of quality tools and supplies |

Immediate repair capability, emergency readiness |

Homeowners wanting self-sufficiency |

Saves money, increases confidence |

|

Understand Your Home's Systems |

Moderate to High – learning curve for technical info |

Low – mostly time to learn and document |

Faster emergency response, informed decisions |

New homeowners and DIYers |

Reduces professional dependence, safety |

|

Plan for Property Tax and Mortgage Management |

Moderate – requires tracking payment schedules |

Low – organisational tools |

Avoids late fees, potential tax savings |

Homeowners managing finances |

Prevents penalties, financial predictability |

|

Set Up Utility Services and Establish Energy Efficiency |

Moderate – involves coordination and some investments |

Moderate to High – setup fees and efficiency upgrades |

Continuous utility service, lower bills |

New movers, energy-conscious homeowners |

Saves costs, improves comfort |

|

Develop a Home Security Strategy |

Moderate to High – requires assessment and installation |

Moderate to High – equipment and monitoring fees |

Increased safety and theft deterrence |

Homeowners prioritising security |

Peace of mind, insurance discounts |

Making Your House a Home: Next Steps

Navigating the initial stages of homeownership can feel overwhelming, but with a well-structured first time homeowner checklist, you can confidently lay the groundwork for a smooth and rewarding experience. From establishing a realistic budget and securing the right insurance to understanding your home's systems and creating a maintenance schedule, the steps outlined in this article provide the essential foundation for success. Remember, prioritising tasks like assembling emergency supplies, managing property taxes and your mortgage, and setting up utilities will contribute significantly to a stress-free transition. Mastering these key aspects of homeownership allows you to not only protect your investment but also build a comfortable and secure environment for yourself and your loved ones. This sets the stage for truly enjoying the benefits of owning your own home, creating a space that reflects your personal style and provides a haven for years to come.

This first time homeowner checklist provides a solid foundation for a successful homeownership experience. Remember that Folders offers a wide range of home essentials to equip your new space, from appliances and tools to furniture and décor, making it easier to check off items on your list and create a functional and stylish haven. Visit Folders today to explore our selection and begin transforming your house into the home of your dreams.